Governance overview

Canada Post's vision is for all Pension Plan members to have a financially secure retirement, and its mission is to prudently administer the Plan for the benefit of its members.

Plan governance

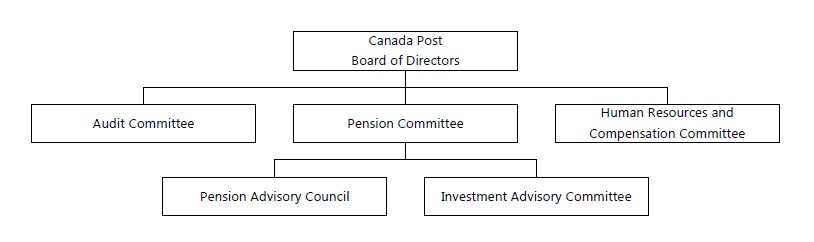

Canada Post, as Plan sponsor, is responsible for the funding of the Plan and its benefit design and, as Plan administrator, it is also responsible for its administration and the investment of the pension funds. The Canada Post Board of Directors (the Board) has a fiduciary duty to oversee these activities to ensure that they are conducted responsibly, in the best interest of all Plan members. The Board carries out its duty by ensuring that prudent investment and administration practices are followed.

To support the Board's fiduciary duty, a robust governance structure is in place. It encompasses the defined benefit (DB) and defined contribution (DC) components of the Plan, the Supplementary Retirement Arrangement (SRA) and the Voluntary Savings Plan (VSP), commonly identified as the Canada Post Pension Plan or CPPP. The table below presents an overview of the Board committees.

The CPPP is administered and supported by:

- Canada Post Pension Services, for the day-to-day financial and administrative functions,

- Canada Post Pension Investment Division for investment management functions of the DB component, and

- Canada Life, as Recordkeeper for some aspects of the management of the DC component and the VSP.

The Plan is administered according to the applicable legislation, under the supervision of the Office of the Superintendent of Financial Institutions (OSFI), the federal pension regulator, and the Canada Revenue Agency (CRA). Some services are also provided by agents of the Plan.

Canada Post acts in accordance with best governance principles and practices. All employees are held to the Canada Post Corporation Code of Conduct. In addition, the Plan Ethical Practices set out what is expected of those employees who are part of administering the CPPP. These Practices address policies and guidelines specific to the CPPP.

The Plan Ethical Practices include the Personal and Insider Trading Practice to ensure Canada Post employees are carrying out investment activities using the highest level of integrity.

Memberships, biographies and mandates

| Memberships and biographies | Mandates (Terms of Reference) |

| Board of Directors of Canada Post | |

| Committees of the Board of Directors | |

| - Pension Committee | Pension Committee |

| - Audit Committee | Audit Committee |

| - Human Resources and Compensation Committee | Human Resources and Compensation Committee |

| Pension Advisory Council | Pension Advisory Council |

| Investment Advisory Committee | Investment Advisory Committee |

Our good governance practices

Monitoring |

This includes the quarterly review of investment performance and funded ratios, as applicable, using reference documents such as the statements of investment policies and procedures and funding objectives. Service performance, service provider contracts, fund manager performance and service level agreements are also monitored regularly. |

Assessment |

Governance practices are assessed annually using questionnaires of the Canadian Association of Pension Supervisory Authorities (CAPSA). The Pension Committee reviews results to determine how successfully the Plan follows CAPSA governance principles and reports findings to the Board. CAPSA has established 11 governance principles that define good governance practices for pension plans in administration and investment management. More information about CAPSA and its governance principles is available at capsa-acor.org. |

Audit |

Internal audit and independent external auditors conduct regular audits. In addition, the Office of the Superintendent of Financial Institutions (OSFI) can also carry out on-site governance reviews from time to time. OSFI did so in 2010. All OSFI's recommendations were addressed promptly by management. OSFI commented that the Plan was managed with excellent controls, processes and oversight, as well as good governance practices. |

Risk management |

The Board has established a risk management framework that defines the risk tolerance in matters of administration and investment. The framework guides the development of strategies to meet overall objectives. |

Communication |

A number of legislative requirements relate to communication with Plan members. These requirements are met with the publication of the annual Report to Members, personalized pension statements, notice of amendments to the Plan, the Pension Plan News and lntouch newsletters and other communications. Most of these publications are available on this website or on the Canada Life member website. The Plan's audited financial statements are available on this site and printed copies are available by request. |